Options are put into phone call options, that allow people to benefit if your price of the newest inventory increases, and set possibilities, where consumer earnings should your cost of the newest stock declines. Buyers may go small a choice because of the promoting these to other traders. Shorting (otherwise attempting to sell) a trip option create therefore imply making money in case your hidden inventory refuses if you are offering a made use of solution will mean profiting if your inventory develops in the really worth. Gamma (Γ) is short for the rate away from change anywhere between an enthusiastic option’s delta plus the root asset’s speed. Gamma means the amount the fresh delta manage change provided a $step 1 relocate the underlying defense.

Well-known alternatives change actions

Market value productivity don’t depict the brand new output an investor do discover in the event the shares had been exchanged in the in other cases. Now you learned the basics of the two main form of possibilities and exactly how buyers and you can people https://shivamsinhaacademy.com/change-simulation-behavior-date-trading-for-free-no-registration-required/ could use these to follow a prospective money or even to help protect a current reputation. Should your shares is actually change in the below $50, it’s impractical that you will do it the decision, for the very same reason why you wouldn’t play with a great $several coupon to purchase a $10 pizza pie.

- Concisely, a lot of time options are discussed risk, directional investments – you want the newest inventory to go on your side, or perhaps the extrinsic worth of you to definitely alternative have a tendency to decay throughout the years and also the option loses worth.

- In the vocabulary out of possibilities, you’ll be able to workout your to find the pizza at the all the way down rates.

- No Hash LLC and you will No Hash Exchangeability Features try signed up in order to do Digital Money Company Pastime by Nyc Condition Company from Economic Services.

- Phone call possibilities and place possibilities is only able to function as the productive bushes when they restrict losses and you may optimize development.

- An used option offers the manager the best—but, once again, not the responsibility—to offer an inventory during the a certain speed.

- If you are considering selling and buying options, here’s what you should know.

How to Research Brings

The fresh efficiency analysis contained herein means earlier efficiency and this does not make sure upcoming results. Investment get back and you will prominent well worth tend to fluctuate in order that offers, when used, may be worth almost than simply the new rates. Latest overall performance could be lower or more compared to performance cited. To possess performance advice current for the most recent day stop, delight call us. Banking services are given from the Morgan Stanley Personal Lender, Federal Association, Associate FDIC.

Kind of Possibilities: Calls and Puts

More go out until termination, the greater amount of options the brand new inventory must relocate the brand new guidance you would expect. Consequently, choices agreements having expiration schedules after that aside is going to be much safer than others expiring in a few days, and, hence, it bring large superior. You will find butterflies, condors, or other steps having numerous “base,” or combinations from writing and buying choices with different hit prices concurrently. Remember that some of these more complex actions may require an excellent advanced out of recognized choices change than level you to definitely.

Getting to grips with possibilities trade: Region 1

Delta in addition to represents the fresh hedge proportion to have performing an excellent delta-neutral position to possess choices investors. If you purchase a simple Western phone call alternative that have a great 0.40 delta, you should offer 40 shares of stock as fully hedged. Web delta to possess a portfolio of possibilities could also be used to discover the portfolio’s hedge ratio. Here, by far the most an investor can be eliminate is the advanced repaid to help you choose the alternative.

Alternatives encompass risk and so are maybe not right for all of the traders as the the new unique threats built-in to alternatives trading can get introduce buyers to help you potentially tall loss. Please read Characteristics and you will Risks of Standardized Choices before making a decision to buy options. Carries and you will options render at some point different ways to be involved in financial places. Brings render lead possession in the a pals and so are used for long-name using. Options are contracts associated with an underlying investment, used for short-label conjecture, money tips, or hedging. The primary distinctions rest inside control framework, chance exposure, time awareness, and you may prospective efficiency.

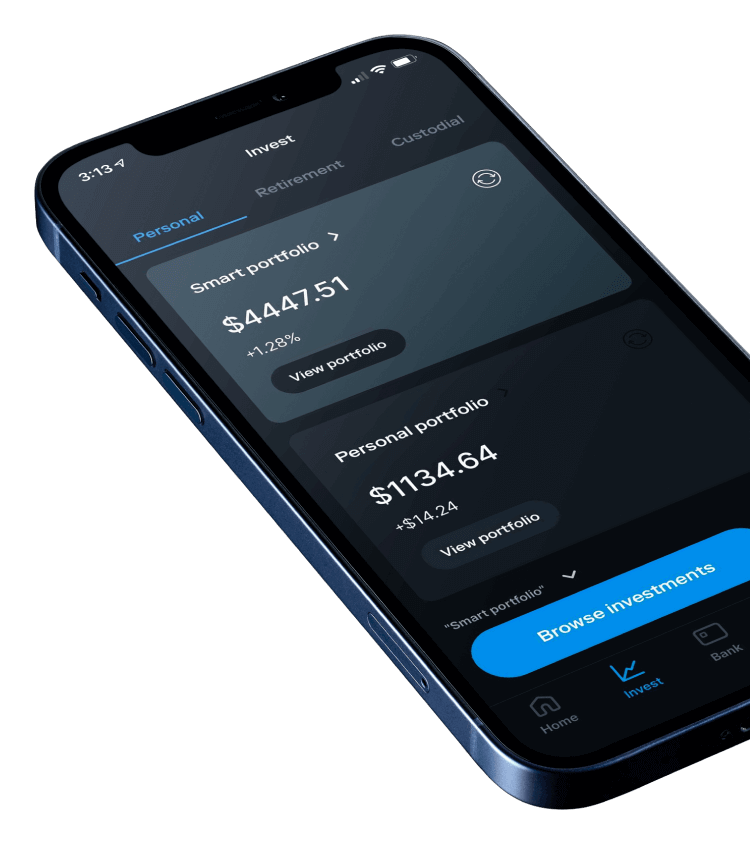

As you search programs, browse the platform’s charge and you will research possibilities. You’ll also need to import money from a connected bank account to your the fresh brokerage membership, which means you have money to get into as you prepare to help you trading alternatives. These steps may help you move from being qualified to trade choices to actually setting the choices exchange. There are many different form of alternatives tips and subtleties you to definitely is only able to be discovered that have experience. But with time, you can learn the needs to optimize the choices trade method.

Quite the opposite, should your stock rate shuts below $50 from the conclusion, the newest small call merchant perform understand a max profit by staying the original borrowing from the bank acquired from $two hundred. They could let the choice end meaningless or purchase right back the brand new quick name to see the new profit and take away any possible assignment risk. Brief name investors should know that there is zero restriction to help you exactly how highest an inventory can go, thus the theory is that indeed there’s endless chance. Small options investors usually find strike prices that they believe tend to are nevertheless OTM by termination.